Are housing prices worse than ever in history?

An attempt of objective apples to apples comparison

Update: I’ve now re-rendered all the graphs and added a follow-up post to reply to critical comments

Recently the following tweet has been making the rounds:

Elon Musk replied to the tweet and as of today it has 28k likes. But… is it actually true? Answering this question objectively requires getting a few definitions straight:

How is “median income” defined?

How is the “median home price” defined?

What is a “median home” in the first place? Are “median homes” the same in 1952 and 2022?

Should mortgage rates be taken into account? After all, that’s how most homes are bought by the bottom 99%.

Does it make sense to compare housing prices across the entire country or does it make more sense to look at regional patterns?

Additionally, it would be interesting to look at other countries for comparison and see if they’ve done any better.

Historical median income

The most accurate statistical resource I’m aware of is Federal Reserve Economic Data (FRED). Wikipedia uses it extensively in their articles on the US economy and I’ll try to avoid using other resources where I can for the rest of this article. FRED has three datasets on median income:

Median family income (1953 to 2020)

Median personal income (1974 to 2020). These values refer to the median person’s amount of disposable income after tax.

Median household income (1984 to 2020). The difference between “family” and “household” is explained on the FAQ page of the Census website.

Ideally I’d use the “personal income” data here to include the impact of changing taxation levels, but this data doesn’t go back far enough so I’ll use the “family income” data instead. Downloading FRED’s dataset we get the following chart:

FRED doesn’t have family income data for 2021 and 2022 yet, so I’ll assume we’ll see them grow by 5% in 2021 and another 5% in 2022, as a guesstimate based on the trendline in the past decade and the high inflation rate in the past couple of years. Note that I’ve specifically avoided getting the inflation-adjusted version of this data, as we’re primarily interested in the ratio between incomes and housing prices for any given year, for which inflation adjustments are not necessary.

Historical house prices

FRED offers two datasets:

Median sales price of houses (1963 to 2022)

Median sales price of new houses (1963 to 2022)

The difference between the two datasets is less than 2% for most quarters, which is a bit puzzling as one would assume that new housing should be significantly more expensive. The Census FAQ on the subject confirms that “new” refers to “newly constructed”, so it’s not a matter of tricky definitions. My current explanation is that new houses tend to be built more often in areas with cheap housing (so Omaha instead of NYC) and therefore the price of new houses sold wouldn’t be much bigger on average for the country as a whole. Using the data from the first dataset we get the following chart:

Mortgage rates

FRED provides data on the average 30-year mortgage rate between 1971 and 2022. We can supplement this with prime rate data from 1955 to 1970, as mortgage rates and prime rates are closely correlated. This results in the following chart:

Interest rates went above 5% in 1966 as the WW2 era subsidies tapered off and didn’t come back under 5% until 2009. As of Q2 2022 it once again breached the 5% barrier, though its not visible in the chart above as I’ve used the average values for each year. Overall rates have peaked in 1981 at 16%, which seems bonkers by modern standards.

Mortgage payments required for a median house

We can now combine the two datapoints above and calculate the yearly payments required when purchasing a median house at any given year. Excel has a convenient PMT function for interest payments, which allows us to generate the following chart. I’ve assumed 0% downpayment for the purposes of this calculation.

Mortgage payments have been growing slower than housing costs thanks to decreasing interest rates since 1981, even when not adjusting for inflation.

Mortgage payments as a percentage of family income

We can now answer the final question: how affordable was it for the average American family to get a mortgage over the years? Dividing the median yearly payment by the yearly income, we get the following chart:

1981 was the most unaffordable year for those who need a mortgage, with annual payments consuming a whopping 52% of their income. For comparison, in 2022 mortgage payments require 27% and the absolute lowest point is back in 1963 when only 18% was required. In 2006 (at the peak of the housing bubble), families would need 30% of their income. Thus we can confidently say that 2022 is so far not the worst year in history for those who can’t afford to buy a house without a loan.

Price-to-income ratio

But what about people who have enough money saved up to buy a house without a mortgage? After all, we’ve all heard stories of houses being so cheap that you could just save up enough money for one by working at the factory. Here’s the result:

The lowest data point is 1970 when the price-to-income ratio was at 2.4 and the highest is in 2022 where its at 4.6. So if you’re an all-cash buyer, 2022 is indeed the worst year in history so far, though the situation isn’t as dramatic as implied in the tweet I’ve quoted in the very beginning.

Home size and quality

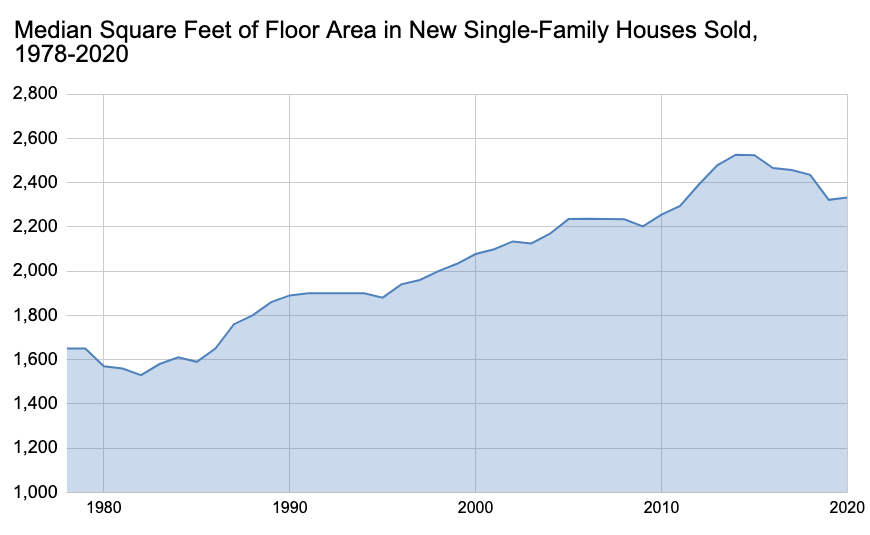

Another confounding factor is that home standards have changed over the years. The Census Bureau provides data on the median size of newly constructed houses:

There has been a 40% increase in floor area since 1978, meaning that newly purchased homes are appreciably more spacious these days. Additionally, construction standards have evolved a lot since 1963 - for example Asbestos was banned from construction only in 1989. So the homes that are constructed today are also of a higher quality than 50 years ago. Most houses also come with AC, in-unit washer/dryer, microwave, stainless steel/granite/marble countertops, separate bathrooms for each bedroom, etc.

Alternative data for the US and other countries

OECD compiles lots of data about member nations on its website, which allows us to double check the numbers. Here’s their version of the price-to-income calculation for the United States:

OECD believes that homes were most unaffordable in 1980 and we still haven’t reached the price-to-income levels of 2006. I’m not sure how exactly their data is calculated as FRED data disagrees about the price/income levels in the 1970s, but its a good way to confirm that Q1 2022 isn’t as catastrophic as claimed. We can now download the full dataset and see which countries had the most extreme change in unaffordability since the year 2000 (included are countries which have data going back that far):

Unaffordability in the US increased by 18%, which placed it in the bottom half of the comparison group. The charts for the two countries leading the chart are pretty stark:

Canada

Ouch! Canadians seem to be affected by the increases even more than Americans and have definitely set a new unaffordability record.

New Zealand

New Zealand soared rapidly during COVID and the situation there is much worse than ever before.

Japan

In contrast, Japan has still barely recovered from the real estate bubble collapse of the 1990s and even COVID only increased the price-to-income ratio by 5% between 2019 and 2021. This might be explained by Japan’s persistent deflation concerns, their unique YIMBY zoning rules or the fact that they’re the one of the fastest shrinking nations in the world.

Conclusion

Is the situation actually “the worst it has ever been in history”? I would argue that the answer is no, at least for the US, as long as you’re planning to take out a mortgage. Could it become the worst in history soon? Yes, assuming that interest rates keep growing and housing prices don’t fall, we could theoretically breach the unaffordability record of 1981. From a quick calculation, at current housing/income levels we would need mortgage rates of 11% for the situation to become worse than it has ever been. Who knows, perhaps we’ll see this happen some day, but as of today that tweet is arguably misleading or at least lacks nuance.

You can find a follow up to comments for this analysis in the next post.

Excellent post.

But does it make sense to look at everything in nominal terms?

Sure, deflating incomes and housing costs by the same factor wouldn't change your analysis. But your analysis is not taking into account non-housing costs, which matter if we are concerned with housing affordability.

For example, even if housing costs and incomes are rising at the same pace, if non-housing costs are soaring, then housing is still becoming less affordable—it's taking up a rising share of household incomes post food, car, clothing, and other necessities.

Thought experiment in real dollar terms, likely wrong:

You're an apple farmer in a 1980 economy that only consumes apples. Apples are $1 (high quality apples) a pop and you farm 100 of them a year.

A house is going for 250 apples today (1980), so $250 dollars. You head to the bank for that full $250 mortgage.

They say, hey, inflation expectations are high right now at 17% so the mortgage rate is 20%, paid annually, but if you're still interested we can offer you something over 25 years.

Shoot, you say, looking at your early MS Excel prototype model, that's $50.5 dollars/apples a year, half my current income this year! But then you notice - with inflation, that'll only be 43 apples at the year 1 payment, 37 at y2, 23 apples at y5, etc. In apple terms, the payment is dropping by over 14% apples a year. In ten years, the NPV of my mortgage will just be 49 apples, payments just 10 apples.

Loan payments in high inflationary environments need to be really front loaded because everything later in time gets nulled; the first payment amount might be high but it becomes nominal quick. In terms of your output, you'll be spending 290 apples over the mortgage term at this 20/17 scenario. Quite a bit better than paying 2x higher priced (600+) at a lower interest rate in 2022, unless you think there is something countervailing going on with opportunity cost.